We’re excited to share this LinkedIn RoundUp edition together with our partners Informa and Private Equity Insights.

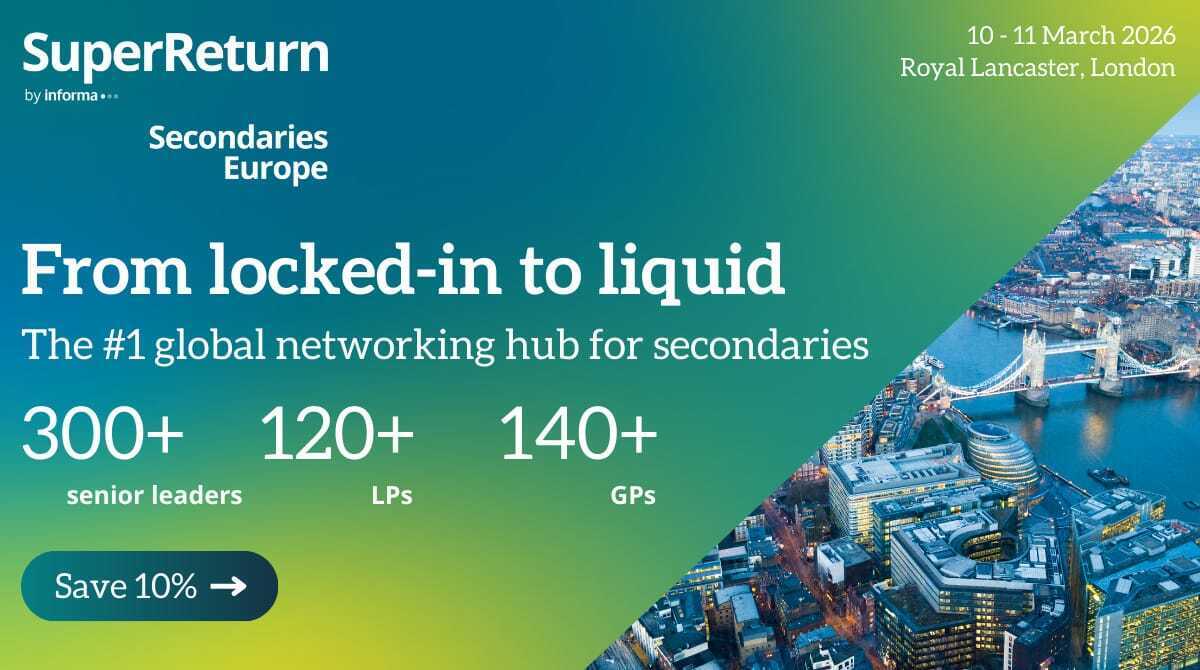

Will you attend SuperReturn Secondaries Europe 2026, 10-11 March 2026?

SuperReturn Secondaries Europe 2026 is the leading conference for secondaries leaders from across the globe. Join 300+ real decision-makers, 120+ LPs, 140+ GPs, and gain insights from 80+ industry experts.

Attend to explore the latest trends and strategies driving growth in the secondaries market; and experience next-level networking with champagne roundtables, women’s leadership lunch, drinks receptions, exclusive LP-only sessions and more!

LPs already confirmed to attend include Temasek, CPP Investments | Investissements RPC, Mubadala, HSBC Alternative Investments, Bpifrance, British Business Bank, Aware Super, Albourne, Brunel Pension Partnership Limited, Rabo Investments and many more…

Thanks to Jasmine Mukerji, we can offer you additional 10% off. Don´t forget to enter the VIP code: FKR3657FRE

Will you attend Private Equity Insights Germany, 13th March 2026 in Frankfurt?

Discover valuable insights, the latest trends, and networking opportunities at Germany's largest Private Equity conference where you'll also get to..

Network with 500+ GPs & LPs

Hear from 60+ industry leading speakers across a variety of panels

Gain tangible insights focusing on Fundraising, Investing, Creating Value, and Exiting

Thanks Hasan Qaiser and Sebastian Tollak.

And here is our Private Equity Summary for CW 06/ 07

Methodology: Every two weeks we collect most relevant posts on LinkedIn for selected topics and create an overall summary only based on these posts. If you´re interested in the single posts behind, you can find them here: https://linktr.ee/thomasallgeyer. Have a great read!

If you prefer listening, check out our podcast summarizing the most relevant insights from Private Equity Insights CW 06/ 07:

Market Cycle & Deployment

Europe is framed as a stagnant 2025 with 2026 as a selective turning point driven by sharper theses rather than a broad boom

Fundraising pressure pushes investors to think harder about where and how fast to deploy, not just how much dry powder remains

Private markets still show resilient buyout and secondaries activity, but capital is now rewarded only where timing, underwriting and value plan are clearly differentiated

Exits & Liquidity

Exits are positioned as checkpoints rather than finish lines, with founders urged to build genuinely sellable assets instead of overgrown jobs

Rollover equity and partial cash outs are highlighted as powerful tools to align founders and management with sponsors across multiple value creation cycles

Secondary funds, continuation vehicles and structured deals expand the liquidity toolkit beyond classic trade sales and IPOs, but weak data and narratives still block stalled exits

Value Creation

A concise, one page value creation plan is favored over complex decks, forcing clear priorities, ownership and pacing of initiatives

Operational alpha is redefined as the outcome of integrated data, fast feedback loops and disciplined execution rather than leverage and episodic cost programs

Investors stress that platforms, playbooks and governance for value creation must exist before raising the next fund, not be improvised once capital is committed

Leadership & Culture

CEO failure in private equity is traced mainly to misaligned expectations and unclear mandates, not capability gaps

The modern portfolio CEO is expected to be entrepreneurial, transparent and adaptable under pressure, supported by specialized roles such as CROs and Group Treasurers

Private equity is described as a spotlight that reveals cultural strengths and weaknesses, making alignment, incentives and resilience central to any investment case

Technology, AI & Data

New deal engines and data platforms aim to make sourcing and screening more precise, turning scattered information into repeatable advantage

AI is shifting software economics and valuation logic, with investors scrutinising revenue quality and sustainability of AI heavy business models

LinkedIn move the conversation from AI enthusiasm toward disciplined adoption, where tools must show tangible impact on sourcing, portfolio performance or risk management

Deal Structures & Sector Plays

Equity pots, management incentives and rollover structures are treated as key design levers to balance motivation, fairness and governance across stakeholders

Buy and build strategies are judged increasingly on integration quality and operating discipline rather than deal volume alone

Knowledge intensive and recurring revenue sectors, from events to professional services, remain attractive where scalable operating playbooks and cash generation are clear

Alternative Capital & Family Offices

Private credit faces stress in parts of the software heavy universe, sharpening focus on underwriting quality and downside protection

Secondaries and evergreen vehicles gain importance as mechanisms to manage duration, visibility and liquidity across portfolios

Family offices are emerging as patient competitors to traditional private equity funds, especially where founders value long term ownership with fewer fundraising cycles

Europe & DACH

European private equity activity is described as recovering, with more exits and entries as pricing expectations gradually converge

The DACH mid-market shows renewed momentum, combining sector depth with a stronger focus on operational value creation in buyouts

Local platforms in niches such as social recruiting illustrate how focused acquisition and integration strategies can build national champions

Mindset & Learning

Practitioners lean on books, practitioner content and global reports to recalibrate expectations on fundraising, deal flow and portfolio design

There is a clear push to stay close to data, question legacy assumptions and refine playbooks around value creation, liquidity and governance for a more complex cycle

Want to see the posts voices behind this summary?

This week’s roundup (CW 06/ 07) brings you the Best of LinkedIn on Private Equity Insights:

→ 71 handpicked posts that cut through the noise

→ 36 fresh voices worth following

→ 1 deep dive you don’t want to miss